Capital That Strengthens Your Legal Practice

Law firms face unique cash flow challenges—case costs mount before resolution, contingency cases take years, and overhead continues regardless of settlement timing. We provide confidential funding designed for legal practice economics.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

From Application to Funding With Professional Discretion

Share your practice areas, firm size, and what you need funding for. We understand the economics of legal practice.

We assess your firm with knowledge of billing cycles, case pipelines, and the unique cash flow patterns of legal services.

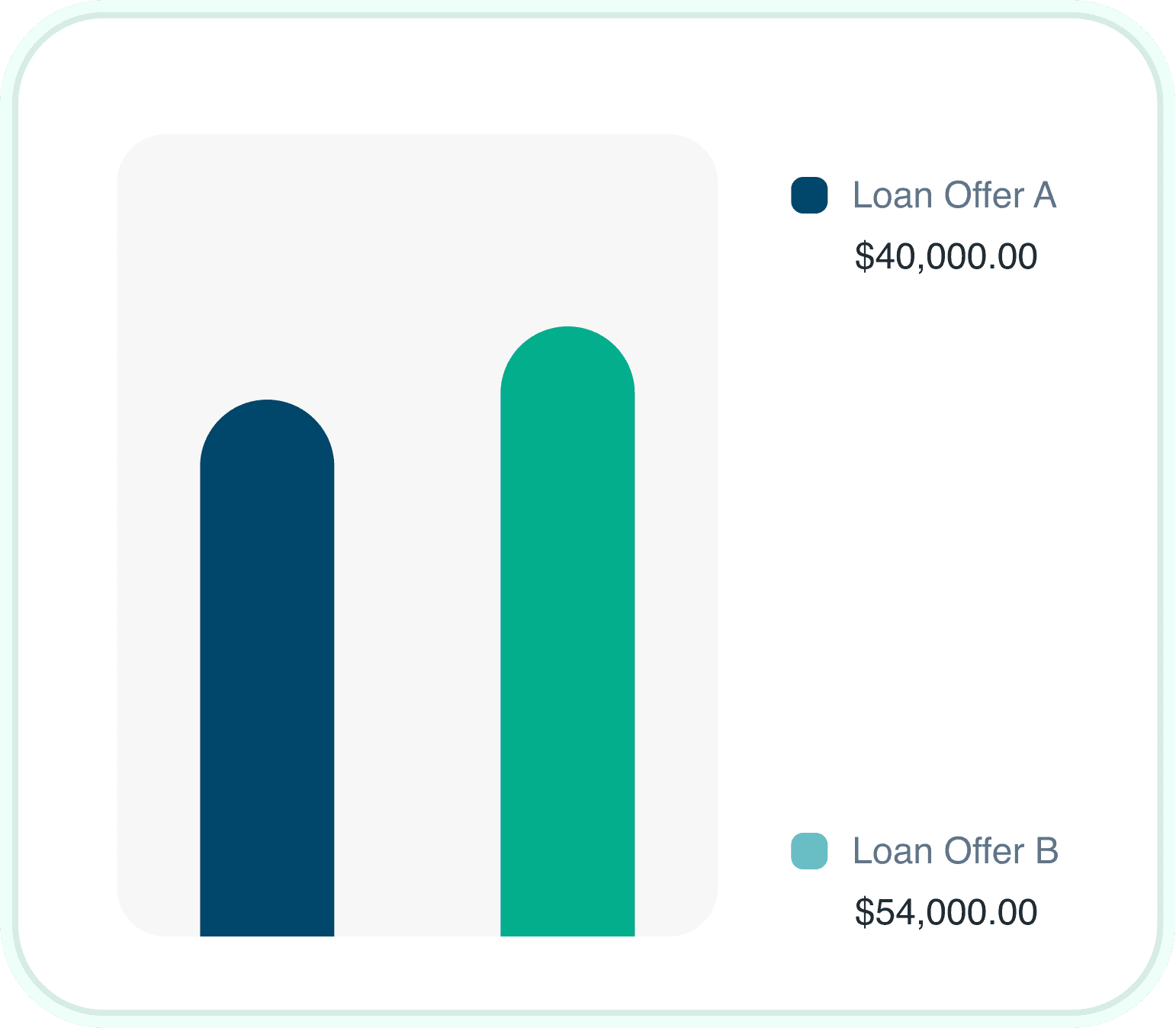

Review multiple funding offers with different structures. Pick what aligns with your case resolution timelines and firm cash flow.

Funds arrive quickly—often within 24-48 hours. Cover case costs, expand your practice, or bridge settlement timing.

Why Legal Professionals Choose Us for Funding

We Understand Case Cost Economics

Expert witnesses, depositions, and litigation expenses accumulate before any settlement or verdict. We help you invest in cases properly.

Settlement Timing Support

Contingency cases can take years while overhead is due monthly. Our funding bridges the gap between expenses and resolution.

Practice Growth Capital

Expanding to new practice areas, opening additional offices, or acquiring a practice requires strategic capital investment.

All Practice Areas Welcome

Personal injury, family law, criminal defense, business litigation, immigration, estate planning—we fund legal practices of all types.

Confidential and Professional

Your financial matters stay private. Our funding process is discreet and handled with the confidentiality legal professionals expect.

Technology and Operations Investment

Case management software, e-discovery tools, and office technology require ongoing investment. We help you stay competitive.

Funding Built for Legal Practice Realities

Whether you need to fund case costs, bridge settlement delays, or expand your practice, we have funding solutions designed for the unique economics of legal services.

Law firms operate with unique financial dynamics. Case costs mount before resolution. Contingency fee structures delay revenue. Technology and talent requirements keep growing. We have spent years learning legal practice economics so we can provide capital that supports your cases and your firm's growth.

Law Firm Funding Overview

We offer multiple products to address different practice needs. Some firms need case cost funding for litigation. Others need working capital to bridge settlement timing. Many use a combination as their practice grows.

Most law firms qualify for multiple products. Your funding advisor will help compare options and recommend the best approach for your practice.

Financing Options for Law Firms

Different practice needs call for different solutions. Here are the products legal professionals use most frequently.

How Credit Affects Law Firm Financing

Your personal credit score is one factor, but not everything. We evaluate the complete picture: firm revenue, case pipeline, accounts receivable, and overall practice performance.

Good News

Legal professionals with credit scores in the 500s regularly qualify for funding when they demonstrate solid firm revenue and healthy case pipelines. Your practice performance tells the story.

Strong Credit Profile

Access to lowest rates, longest terms, highest amounts

Challenged Credit

Multiple options available based on practice performance

Legal Services Industry Insights

12-36

average months for contingency case resolution. Our funding bridges the gap between case expenses and settlement or verdict.

(Source: Legal Industry Survey)

$50K+

average annual technology investment for modern law firms. Staying competitive requires ongoing investment in tools and systems.

(Source: American Bar Association)

60%

of law firms use external financing for growth or case funding. Capital is a normal part of legal practice operations.

(Source: Legal Management Survey)

Evaluating Law Firm Financing

Fund case costs to pursue larger matters

Bridge cash flow during settlement delays

Invest in practice expansion

Hire and retain talented associates

Upgrade technology and systems

Build credit history for better future terms

Financing costs reduce overall margin

Some products require frequent payments

Personal guarantees may be required

Fast funding options typically cost more

Compare Law Firm Funding Options

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Business Line of Credit | $25K to $300K | 1% to 3% monthly | 1 to 3 days |

| Working Capital Loan | $25K to $500K | 1% to 3% monthly | 24 to 48 hours |

| Revenue-Based Financing | $25K to $500K | 1% to 5% monthly | 1 to 3 days |

| Business Term Loan | $50K to $750K | 8% to 20% APR | 3 to 7 days |

| SBA Loan | $50K to $750K | Prime + 2.75% | 8 to 12 weeks |

Law Firm Qualification Requirements

$20K+

Monthly Revenue

500+

Credit Score

1+ year

Time in Practice

Get Funding for Your Law Firm

Apply today and receive funding decisions quickly. Our team understands legal practice financing and maintains strict confidentiality.

Start Your Application

Complete a confidential application about your practice, including your areas of focus, firm revenue, and funding needs.

Upload recent bank statements and basic firm information. All documents are handled with strict confidentiality.

Review your offers, choose the best fit, and receive funds. Most law firms get funded within 24 to 48 hours.

Law Firm Funding Products

Explore specific financing options available for your legal practice.

Related Industries We Fund

We also specialize in financing for these related professional services.

Law Firm Financing Questions

We fund personal injury, family law, criminal defense, business litigation, immigration, estate planning, real estate, and all other practice areas.

No, we provide business capital to law firms, not settlement advances to plaintiffs. This is funding for your practice operations and growth.

No. Your financing is confidential business information and is not disclosed to clients, opposing counsel, or anyone outside your firm.

Yes, funding can cover expert witnesses, court costs, discovery expenses, depositions, and other litigation costs.

We look at firm revenue history, case pipeline, accounts receivable, and overall practice performance—not just case outcomes.

It matters, but firm performance often outweighs credit challenges. Strong revenue and healthy case pipelines matter significantly.

Many firms receive decisions within 24 hours and funding within 24-48 hours. SBA loans take longer, typically 8-12 weeks.

Basic requirements include 3-6 months of bank statements, a valid ID, and proof of business ownership. All handled confidentially.

Ready to Strengthen Your Practice?

Whether you need case funding, working capital, or growth financing, our team specializes in law firm financing and maintains complete confidentiality.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score