Empowering Small and Medium-Sized Businesses

We specialize in providing quick, flexible access to working capital helping your business grow and thrive

With over $200 million in funding distributed to American businesses.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

More Than a Financial Marketplace

We're a growth partner. We offer a variety of capital solutions tailored to your business needs. With integrity, transparency, and personalized service, we've helped countless business owners secure the funding they need to succeed.

Get Started

How it works

Simple Application

Complete our streamlined online application or request a personalized application via email from one of our knowledgeable agents.

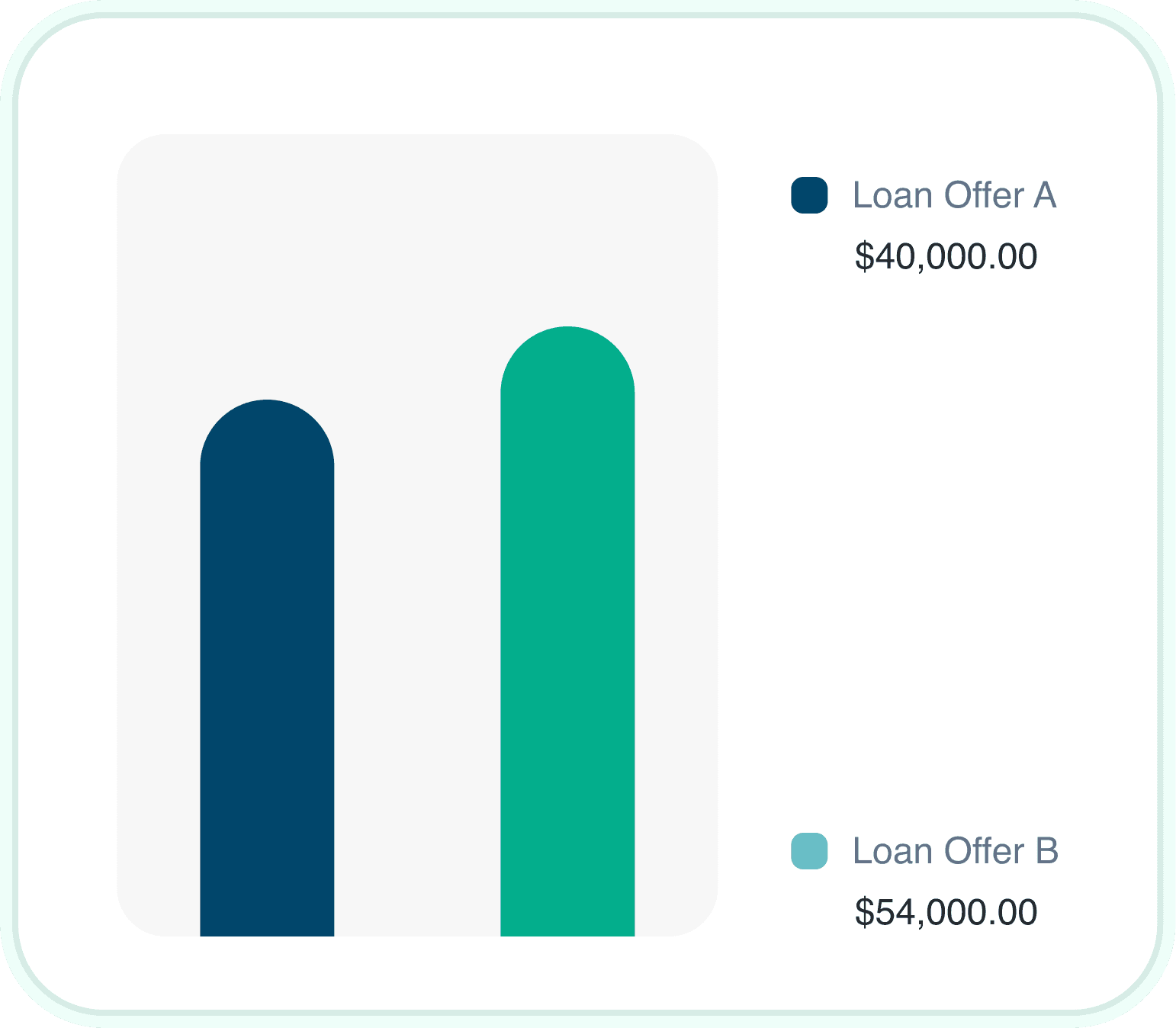

Fast Tailored Offers

With minimal documentation, we can often offer up to 120% of your monthly gross revenue. You'll then receive a variety of customized funding options designed to meet your unique needs.

Dedicated Support

Every client is paired with a personal financial advisor who will work with you throughout the process from your initial submission to the final funding decision.

We proudly support a diverse range of businesses including:

...and more

Loan Offer

$4500

Ready to boost

your business?

Let's start the conversation. Complete the form below, and one of our financial experts will reach out shortly.

Contact Us

Questions or queries? Get in touch!

Phone

Mon-Fri from 8am to 5pm.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score